A Loan Management Solution

for Bridging Lenders

The Bridging Hub is a web-based, user-friendly, and intuitive Loan Management Solution, developed for bridging lenders, with over 15 years of experience. It serves as an essential tool designed to streamline the loan management process, centralising key information that traditionally requires multiple spreadsheets, word documents and filing systems.

Our Features Help With

Scattered Information

Bridging lenders often struggle with scattered information across multiple spreadsheets and documents, leading to inefficiencies and errors. Our system provides a centralised repository where all essential loan data, such as key financial information and client information, are securely stored and easily accessible. The Bridging Hub consolidates both customer and loan information into a single, intuitive platform, eliminating the need to manage data across multiple sources.

Administrative Overload

The administrative burden of reconciling data and manually producing documents can be time-consuming and redundant. Our Document Production Engine automates this process by seamlessly mapping stored data into pre-designed templates, including essential documents such as loan offers and solicitor instructions etc. This automation reduces document production time by up to 75%, allowing lenders to focus on strategic business initiatives such as client acquisition and relationship management.

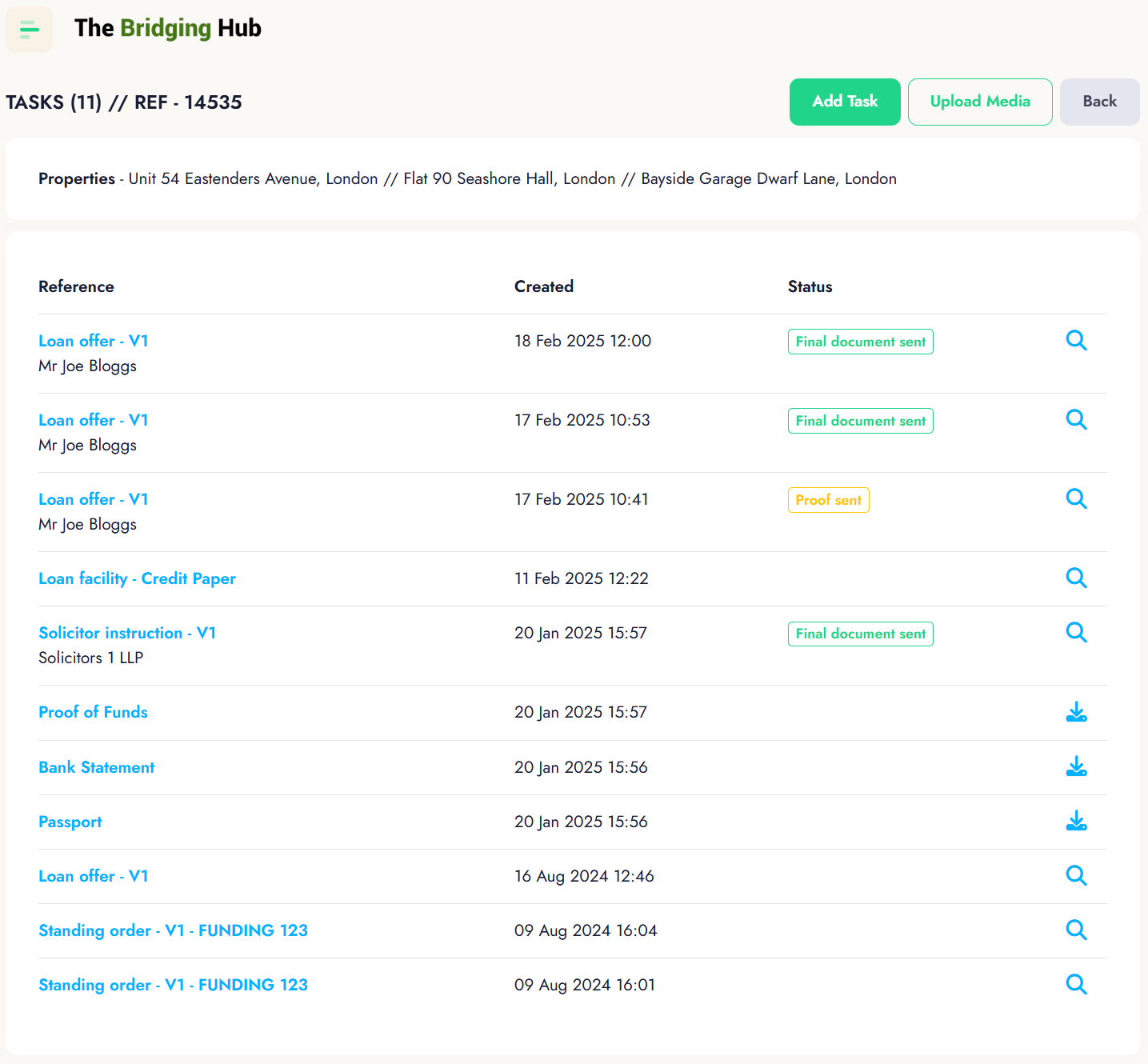

Disorganised Document Storage

Searching through emails and file management systems for crucial loan-related documents can delay processes and lead to missed opportunities. With The Bridging Hub, all important documentation, such as credit papers and legal agreements, is securely stored in one centralised location, ensuring quick retrieval and smoother workflows. This streamlined approach contributes to faster loan completion times, enhanced client satisfaction, and a competitive advantage.

Cumbersome Signature Collection

Traditional methods of obtaining signatures, such as scanning or mailing documents, can cause significant delays. Our E-Signature module enables lenders to collect signatures digitally on essential loan-related documents, accelerating the signing process and enhancing convenience for all parties. This feature eliminates the reliance on physical signatures and facilitates a seamless document execution process.

Investor Allocations

Managing investors and tracking their returns across various loans can be complex and error-prone. The Bridging Hub simplifies investor management by providing tools to assign investors, monitor their returns, and generate comprehensive reports. This ensures transparency, accountability, and ease of tracking.

Reporting

Extracting relevant loan and investor data should not be a challenge. Our system offers purpose-built reports, allowing lenders to generate detailed insights at the click of a button. The intuitive reporting system focuses on delivering key data without unnecessary complexity, helping lenders make informed decisions efficiently.

Data Accessibility

The modern lender needs access to critical information anytime, anywhere. Our system is designed to be fully accessible across desktop, mobile, and tablet devices, ensuring lenders can retrieve essential data on the go with an internet connection, enabling them to stay responsive and agile.